Intelligent tools for agencies

Digital engagement and payment experience software products that make converting and retaining clients for life easier.

Why use Simfuni?

Simfuni offers a digital toolbox of highly scalable payment and compliance workflow modules that can be customized and rapidly deployed within any direct insurers existing architecture. Our technology improves operating efficiencies and modernises policyholder experiences.

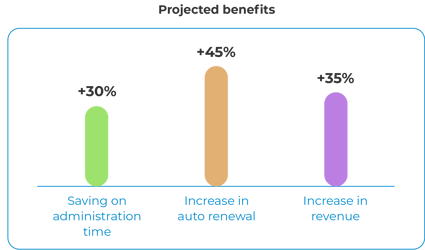

Scale customers and revenue

There’s a lot of manual handling for brokers which can be simplified to improve operation efficiency, increase auto renewals and the bottom line. See what difference Simfuni could make for you:

Request a demo

Modernise insurance premium payments and back office automation

Automate back-office

Eliminate manual handling of paper invoices or PDF attachments with automated digital invoicing and get payments in faster.

- Email and text message notifications

- Integrates with any administration system

- Endorsement invoicing

- Automated renewal invoicing

Modernise payment experiences

Make paying for insurance as seamless as paying for a streaming service. The Unified Checkout Engine provides customers with payment options and payment methods to make paying easier.

- Multiple payment methods

- Multiple instalment frequencies

- Pay via desktop, tablet, or mobile

- Automated recurring payment process

Future proof your workflows

You can now grow your business with the Revenue Control Hub™. Automated tracking and managing of payments means more time to scale and look after customers.

- Real-time visibility and control of your revenue

- Single dashboard view of all receivables

- Instant reconciliation of all payment types

- Digital arrears management and reminder services

Ready to go solutions

The Simfuni platform is the cost-effective solution that is available today. A collection of plug and play modules accelerates the speed of implementation. With security, regulatory, and compliance concerns taken care of, the simple onboarding process makes it quick and easy to get started.

Powerful features to optimise

financial operations for agencies

integration

Integrate your current premium funder into a modern digital online payment solution. The unified checkout combines simplicity and efficiency.

ready

Support online distribution with ready-to-deploy payment and instalment workflows that seamlessly integrate with your existing platform.

self-service portal

Our client portal offers customisable options that align with your brand and clients’ needs. Enabling self service and agent escalation when required.

hub

Real-time visibility and instant matching of all inbound payments across bank account, premium funding, and cards.

comms

Automated communication workflows with integrated payment options designed for efficient arrears management and renewals.

data security

Protect policyholder data with the latest digital security standards to prevent data leaks or breaches. Simfuni is PCI DSS compliant and SOC2 certified.

Deploy your own suite of customised workflows fast

Simfuni has over 30 automated workflows which significantly reduce manual handling of data to help improve efficiency and the customer experience. These have been developed as a micro service which can be selected and integrated into any existing administration platform.

/Screenshot%202023-12-19%20at%201.47.20%20PM.png?width=300&name=Screenshot%202023-12-19%20at%201.47.20%20PM.png)

Checklist for agencies

Benefits to agencies

- Instant reconciliation

- Automated distribution of premiums

- Comprehensive reporting and analytics

- Seamless integration with existing systems

- Secure & compliant workflows

- Automated digital credit control

- Document storage and presentation

- Customised branding

Benefits to policyholders

- Digital checkout experience

- Multiple payment options

- Flexible payment terms

- Self-service portal

- Instant access to insurance documents

- Text and email notifications

- Automated policy reminders

Seemless integration

Simfuni was built using API first principles for partners to be able to access all feature modules. It’s simple to deploy and integrate across any existing technology stack using industry standard API design principles.

- API first principles

- Knowledge Base for onboarding

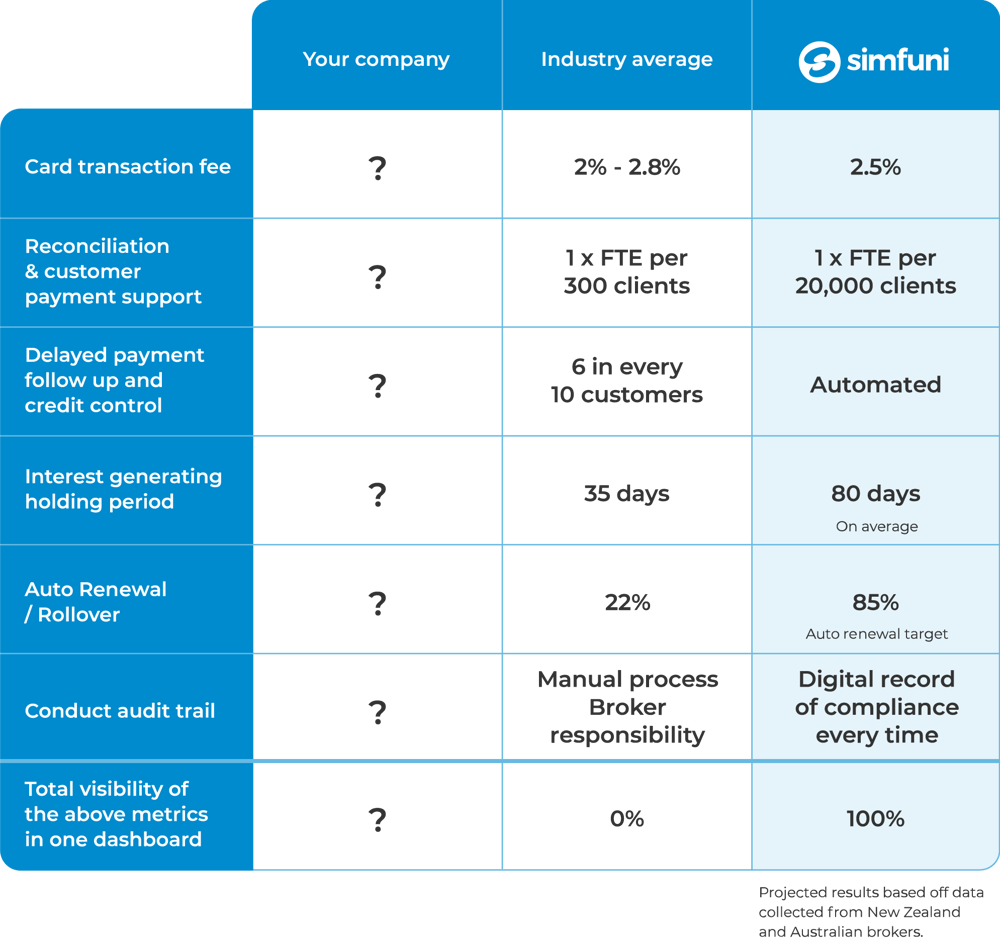

What are payments costing your business?

There’s many known and unknown costs that many brokerages are paying. For example, the time brokers spend on chasing payments from customers is time they could be growing their customer base.

Hear what our customers think

Omnis et optaes pedit, nectur repra sime ped qui cum velenit lanietur, toriatur magnistemod utem quo eost lit erit es id que volendante con nihiciet poritat prae pelibusdam consectuscit fugia volupta tibeat. To ommolup tasseru mquatiliquia vo.

Omnis et optaes pedit, nectur repra sime ped qui cum velenit lanietur, toriatur magnistemod utem quo eost lit erit es id que volendante con nihiciet poritat prae pelibusdam consectuscit fugia volupta tibeat. To ommolup tasseru mquatiliquia vo.

Local delivery and support

Delivering new software solutions into enterprise environments can be a high-risk and time-consuming process. Multiple points of failure can exist across the organisation, and program. Simfuni lowers delivery risk with pre-built, tested workflow products and local project management and delivery teams.

Learn more about Simfuni modules

and what they can do for you

Enter your email address below and we'll arrange a complimentary discovery call to see how Simfuni can help you.

Trusted by