Why use Simfuni?

Simfuni offers a digital toolbox of highly scalable payment and compliance workflow modules that can be customized and rapidly deployed within any direct insurers existing architecture. Our technology improves operating efficiencies and modernises policyholder experiences.

Software that modernises insurance management

Evolve faster by deploying secure digital products that accelerate modernisation in back office operations and customer experience.

Modernise customer experiences and the back office with ready-to-deploy workflows

Future ready insurance workflows

Technology is rapidly changing the competitive landscape of the industry. Modern tools can be slow to develop and high-risk to implement. Simfuni's products enable rapid and secure incremental transformation.

- Ready-built modules

- Integrates with any core platform

- AI ready engagement tools

- Transform customer and operator experiences

Modernise insurance premium payments

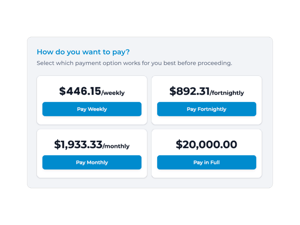

Make paying for insurance as seamless as paying for a streaming service. The Unified Checkout Engine provides customers with cash-flow-friendly options and payment methods to make paying easier.

- Instalment and renewal engine

- Embedded payment solutions

- Omni-channel payment enablement

- Connect core platforms with client payments

Automate and connect back office

Visibility, control and actionable insights from data are core to evolving great experiences. Simfuni connects core systems centralising customer and payment data into intuitive dashboards that simplify and delight both operators and managers.

- Real-time visibility and control of your revenue

- Single dashboard view of all receivables

- Instant reconciliation of all payment types

- Digital arrears management and reminder services

Modular feature deployment

The Simfuni platform is the cost-effective solution that is available today. A collection of plug and play modules accelerating speed of delivery. Security and regulatory compliance has been done. Incremental evolution across the areas you need it most lowers both cost and delivery risk.

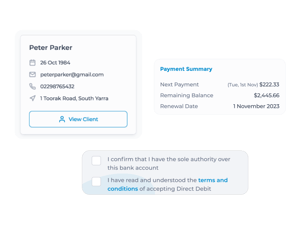

Automate and audit compliance tasks

Automated insurance premium workflows and security ensure compliance with insurance legislation, data protection regulations, and other industry-specific standards.

- Audit customer contacts

- Ensure disclosure delivery

- PCI DSS compliant

- SOC2 certified

Powerful features to optimise

financial operations for insurers

automation

Connect core platforms and payments into a single operator dashboard. Transforming operator and customer experience.

ready

Support online distribution with ready to deploy payment, instalment and renewal workflows.

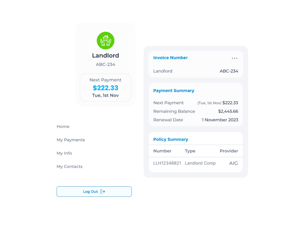

self-service portal

Our client portal offers customizable options that align with your brand and clients’ needs. Enabling self service and agent escalation when required.

Hub

Real-time visibility and instant matching of all inbound payments across bank account and cards.

comms

Automated communication workflows with integrated payment options for arrears management and renewals.

data security

Protect your policyholders data with the latest digital security standards to prevent leaks or breaches. Simfuni is PCI DSS compliant and SOC2 certified.

Checklist for a modern insurance platform

Benefits to insurers

- Instant reconciliation

- Comprehensive reporting and analytics

- Seamless integration with existing systems

- Secure & compliant workflows

- Automated arrears management

- Document storage and presentation

- Customised branding

Benefits to policyholders

- Digital checkout experience

- Multiple payment methods

- Flexible payment terms

- Self-service portal

- Instant access to insurance documents

- Text and email notifications

- Policy reminders

Local delivery and support

Delivering new software solutions into enterprise environments can be a high-risk and time-consuming process. Multiple points of failure can exist across the organisation, and program. Simfuni lowers delivery risk with pre-built, tested workflow products and local project management and delivery teams.

Learn more about Simfuni modules

and what they can do for you

Enter your email address below and we'll arrange a complimentary discovery call to see how Simfuni can help you.

Trusted by